This post may contain affiliate links. Read our disclosure here.

Prescriptions can be incredibly expensive, and for many they are no longer covered by our insurance plans. There are a number of tricks and tips you can use to cut costs and save on prescriptions for everyone in the house (even your pets!).

Even if you have insurance that “covers” prescriptions you are possibly not getting the best prices. Never assume the “with insurance” cost is the best option. The last 3 prescriptions we had filled were all double the price using insurance than they were once we asked the pharmacy to remove the insurance and try other savings methods…

Let me put on my Registered Nurse hat for a moment and share some of my tips for cutting your prescription costs.

13 Ways to Save on Prescriptions:

- Be upfront with your doctor.

Tell them right off that you don’t have prescription coverage. Their goal is to get you better, and that means having you take the medication they prescribe. If something is too expensive, many times there are other options they can pick. Don’t be afraid to ask for free samples and coupons if they have them.

If you get to the pharmacy and the prescription is super expensive, it never hurts to call and ask if there is another medication you could try instead. This was step one for us in saving this weekend:

After hearing the price for my husbands $171 eye cream, I asked the pharmacist if there were other options that might be cheaper (the pharmacist is your friend). He shared that had the doctor ordered an ointment instead of the cream it would be $50 rather than $171. To save $121 I’ll gladly call and ask the doctor if we can switch from a cream to an ointment!

- Always Call/Search Around

Once you have a prescription you should always call around to see who has it cheaper. You’ll be surprised the price differences and who is cheaper. Typically the smaller pharmacies have the best deals, or head to Costco, Sam’s or Walmart.

The worst folks in town are the national pharmacy chains… that $50 ointment at CVS is $9 at Walmart for the same tube (much better than the $171 we started with).

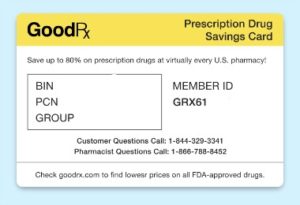

If you want to save the phone calls, use the database at GoodRX to search prices. While it may be off a little from the actual price I’ve found it to be pretty reliable.

- Head to Warehouse Clubs

While they don’t want to you to know this, you do not have to be a member of Sam’s, Costco and other warehouse clubs to be able to use their pharmacies! Just tell the person at the door that you are headed to the pharmacy and they will let you in. You’ll get the same prices as members do for all prescriptions!

Note: This doesn’t mean they have the best price, but often their 3 month supply prices are very competitive. You can also get prescriptions mailed to you for free, so you don’t even have to head in.

- Price Matching

Several stores have a price matching policy that helps you to get the lowest price all in one place. Kroger and Walmart are two of the larger stores that have this policy. Gather all the prices from when you called around, and then head in to price match.

- How To Transfer Your Prescription

Once you have found the lowest price you can, have the new pharmacy call and transfer your prescription to them. They are glad to do this as they just won your business! Obviously if you have a paper prescription you can skip this step, but most of us have things called in now or sent over electronically. CVS won’t know or care that your prescription got moved, if they do they should have thought about their pricing a bit more.

Tip: If you have trouble pharmacy to pharmacy (you shouldn’t really), just call the doctors office back and ask them to send it somewhere else. Most of them do this with a click of a button now and it really isn’t a problem.

- Prescription Savings Cards & Memberships

If you have no prescription coverage (like us) then at least start with a free savings card from GoodRX. It’s free there is no reason not to try it first.

If you have a number of prescriptions, it may be worth it to pay for a membership plan at Walgreens or Rite Aid. Both plans are around $20-$35 a year depending on whether it’s for an individual or family. They have a full list of covered medications and prices on their sites, so search for your meds to make sure the savings is worth it.

- Free Prescriptions

If you’re in need of antibiotics or diabetic medicine, check out Publix. They offer Free Lisinopril, Amlodipine, Select Antibiotics, & Metformin. There are no forms to fill out and it doesn’t matter who your insurance provider is, Publix will give these to you for free.

If you don’t have a Publix near you, many stores offer discounted prices on select prescriptions like Walmart’s $4 prescriptions.

- A Prescription is Cheaper than OTC

While it may seem backwards, there are some medications that folks take regularly that will be much cheaper to get a prescription, instead of continuing to pay over the counter prices (OTC).

A huge example for us was Prilosec OTC. Even buying house brand OTC can’t compare with the prescription price! For the same milligrams per tablet, we can get 3 months (90 tablets) of Omeprazole from Publix for $7.50 (see all the medications on their 3 months for $7.50 list). That would run over $50 for name brand Prilosec or $27 for house brand.

Another example would be Zrytec. Get 90 tablets for $7.50 or get it over the counter for $30+.

- Call the Drug Manufacturer

Just like we may call a grocery brand if we have a question or complaint, you can always call the manufacturer of your prescriptions. Many of them offer discount cards, rebate programs and other savings options. The only way to know about them is to call!

- Always Get 3 Month Supply If You Need It

For any medication that you take regularly and plan to take for a long time, you should always be ordering the 3 month supply. You can do this at the local pharmacy or look at mail order pharmacies.

Cost savings can be huge for some medications, and even folks who just pay a co-pay will find the co-pay is cheaper! Depending on the pharmacy they may require the doctor to write that a 3 monthly supply is okay on the prescription.

Tip: On many medications your doctor can write for more tablets. That means more pills in one prescription, for any one paying just the co-pay this is a huge savings! While it’s not possible for every medication, it never hurts to ask.

- Prescription Assistance Programs

If you have no coverage for prescriptions there are a few programs that you can turn to. Many were started by pharmaceutical companies and give discounts on specific medications only, but if your medication is one of them you could save up to 45% off!

Partnership for Prescription Assistance

- Gift Card Deals

Many pharmacies will at one time or another offer gift cards when you transfer a prescription or start a prescription with them. This is money that goes right back in your pocket!

If you find this gift card offer in the form of a coupon (sometimes in the Rite Aid weekly ad and other places) you can always see if another store will honor the same deal and give you a gift card to fill with them.

- Reward Programs

A number of stores have rewards set up to encourage you to remain loyal. At the drugstores you can earn rewards on your prescription purchases that will act like money off on other purchases in the store. A number of grocery stores will give you fuel savings if they run a gas savings program. These rewards can seem insignificant because it doesn’t come back as cash, but they will definitely help save you money.

Warning: Don’t let these rewards keep you loyal if you are paying out of pocket for most medications. They aren’t worth overpaying significantly! For folks paying only a flat co-pay though, they are great!

What tips do you use to save money on prescriptions?