This post may contain affiliate links. Read our disclosure here.

It’s the beginning of a new year, which is when many people make goals regarding their finances (for more, see how to set yearly goals). Maybe you’ve already got a solid budget and have plans to set aside money for vacation and Christmas. You’re ready for the next step in growing your finances.

Why not try dipping your toes into investing? There are several easy investing apps that let you start investing in stocks and portfolios without having a ton of cash on hand. In fact, in the 5 easy investing apps I’m going to mention, the highest amount you need to start investing is only $100.

5 Easy Investing Apps You Might Not Know About

Acorns (Website)

Acorns has three tiers of plans for users—$1, $2, or $3 a month. There is no minimum amount needed to open an account; but you need at least $5 in your account to begin investing. This is one of the best investing apps for those who want almost completely automated investing. The initial tier ($1/month) is called Invest. You link your bank accounts to the app, and purchases made from those accounts are rounded up. The difference goes into your account and are invested in ETFs (exchange-traded funds). The other tiers have IRA accounts for retirement and checking and savings accounts. With Acorns, you pick from some of their pre-selected portfolios, which is great for those new to investing.

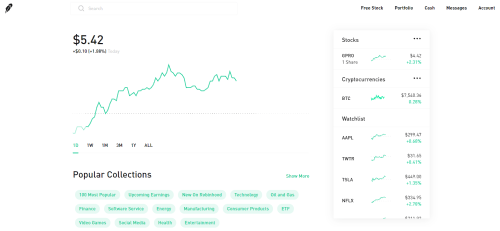

Robinhood (Website sign up online before downloading app)

Robinhood is my favorite of these easy investing apps. The overall cost is $0—that’s right, there is no monthly fee. The minimum account amount is $0, although you’ll obviously need to put some money in to buy your first stock. That said, you’ll get a free share for signing up through this link, and you can earn more free shares by inviting your friends to join.

This app is great for beginners who don’t know much about investing but want to get their feet wet. Trading is completely free, and you can choose which stocks you want to buy. They are soon planning to roll out the ability to purchase fractional shares so that, for example, you could own 1/4th of a share in Amazon, if you wanted.

I’ve been using Robinhood for almost 2 years now and pick stocks that I know things about. I have shares Home Depot (that are up 35% since I invested) and other similar companies. I’m not a big investor, but I use this like a savings account putting a little money in each month.

Stash (Website | App Store | Google Play)

Like Acorns, Stash has three tiers: $1, $3, and $9 a month. You need to put in $5 minimum to open an account, and there is an annual fee of 0.25% for balances over $5,000.This is another easy investing app that’s good for beginners because not only can you own fractional shares (parts of a share), but you can sell and trade stocks for free. You have a little more control over your stocks with Stash if you want; you can choose single stocks or you can choose ETFs or portfolios that have pre-selected stocks.

M1 Finance (Website | App Store | Google Play)

Until I started researching for this post, I had never heard of M1 Finance, but it came up as a favorite among the easy investing apps. It costs $0 to trade and there are no monthly fees. There is no minimum amount to open an account, but you won’t be able to start investing until there’s $100 in your account (So maybe you could start putting in $25 a month, and in 4 months you’d be able to start investing!). Like Stash, there is the option to pick your own stocks and funds or to choose from a variety of pre-selected options.

Stockpile (Website | App Store | Google Play)

Stockpile was started as a way to give stocks as gifts to other people. Many use it to get children and teens on the path to learning more about investing. It costs 99¢ to trade a stock, and if you want to gift someone with an amount to choose their own stocks, it costs $2.99 + 3% of the card value (so if you wanted to give your nephew $100, it would cost you $105.99). The minimum account amount is $5. You can buy fractional shares and either pick stocks or ETFs. One of the appeals of this easy investing app is that kids could choose stocks in brands they’re familiar with—perhaps your daughter wants to buy stock in Barbie, and your son wants a share of Nike? This seems like a fun way to get kids started with learning more about investing, but it is also a good option for adults who want to get their feet wet.

Have you used any of these apps? Let us know your experience in the comments!