This post may contain affiliate links. Read our disclosure here.

As of this week you can officially get great interest rates on checking and savings accounts again!!

A few different banks are all offering up to 2% APR for their savings and checking, plus they aren’t requiring any minimum balances! I know changing banks is never easy, so consider using these as a great online savings account in addition to your current bank.

Having a savings account that isn’t at your normal bank is actually my #1 tip for saving more money. It’s kind of an “out of sight, out of mind” tip. Most online savings accounts take 2-3 days to transfer money to your local bank so it protects you from spur of the moment purchases as well.

Good Interest Rate Options

SoFi Bank – 2% APR on Savings and Checking Accounts with any direct deposit. No minimum balance and no monthly account fees. Details here.

Bask Bank – 2.02% APR on Savings Accounts. No minimum balance or direct deposit required. Does not offer an ATM card, you can easily transfer money to and from this account to any checking account though. Details here.

ally Bank – 1.60% APR on Savings Accounts. No minimum balance or direct deposit required, no monthly fees. Transfer money to and from this account to any checking account though. Details here.

Capital One – 1.5% APR on Savings Accounts. No minimum balance or direct deposit required, no monthly fees. Transfer money to and from this account to any checking account though. Details here.

Highest Interest Rate Possible

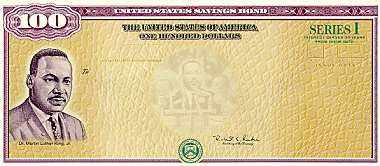

If you already have savings that you are considering putting into a CD or something similar, I strongly recommend buying Treasury I Bonds. These are offered straight from the US Treasury and are paying an extremely high 9.62% interest rate right now.

Rates readjust every 6 months but will stay much higher than your local bank for quite a while. You only need to keep your I bonds for 12 months, so the time limit is also much better than most CD’s. (You can keep them much longer than that, 12 months is just the minimum.)

Purchase I bonds here, or get more information.

Every US Citizen can only purchase $10,000 in I bonds per year. You can purchase as low as $25, so everyone can get in on this great interest rate!!

Note: Interest earned on savings accounts and I Bonds are all taxable.