This post may contain affiliate links. Read our disclosure here.

Parents aim for their kids to be better or smarter than them in everything they do. One area that can get forgotten though is financial literacy and money management. Can they make smart money decisions, balance their accounts, and not overspend? This is not taught in schools!

We need to help them learn financial skills before they leave home. Don’t be afraid to teach them, even if you’ve struggled with managing your own finances. Sometimes sharing our struggles and even bad decisions can be the best way to start a conversation. Here are some basic topics and discussions you should have if you’re wondering how to teach kids about money.

Teaching Kids Money Management

Every family has different goals and values, but money affects all of us. Depending on the ages of your kids, choose which of these issues are relevant right now.

Let them practice using money

Some families do allowances and some don’t. While this isn’t where I’m going to go into all the different thoughts behind an allowance, I do think there’s value in your kids having money to use so they can make mistakes and learn. Whether you tie an allowance to chores or not, it’s important for them to have some money at their discretion from a young age.

Teach spending / saving / giving

When your kids start acquiring money, whether it’s through an allowance or odd jobs, teach them to divide their money into three categories: spending, saving, and giving. The percentages are up to you, but we usually start with our kids having them put 10% in giving and 10% in saving. As they get older, we increase the percentage that goes into saving. Of course, they can always add more to saving or giving if they want, but those are the minimums.

For younger kids, it’s great to use cash and keep it visual. You can buy an expensive piggy bank with dividers, but if you’re giving your kids an allowance, just have three separate containers. We always use Mason jars since they’re see through.

Talk about money as a family

Did you grow up hearing that it wasn’t polite to talk about money? Well, it may not be polite to ask someone how much money they make, but in your own home, you have to talk about money. You don’t have to tell your kids every detail, but they need to understand how money works into the life of an adult.

For example, when my kids have asked for their allowance in advance of the next month, I explain that’s not how my paycheck works. I get paid on such and such days, and I can’t access the money ahead of time.

I also like to frame the conversation about money in terms of choice rather than saying things like “We don’t have the money for that.” Unless you are truly living below the poverty line, you hopefully have money for all your basic necessities. So when you say that you don’t have the money to go out to eat or buy them a certain toy, it’s because you have CHOSEN to use your money in a different way.

To put it practically, when your kids ask to go out to eat and it’s not in the budget, you can explain that that part of your budget is already spent. “We budgeted X for eating out this month, and we already spent it when we went to McDonald’s last week. The rest of our money we are choosing to spend or save on different things, so we’ll have to wait until next month.”

Encourage them to work for money

Even if your kids aren’t old enough to get a job outside your home, you can pay them for jobs or encourage them to ask neighbors or friends or family for opportunities to make money doing odd jobs. We don’t tie our kids’ allowances to chores, but there are extra tasks they can do around the house and outside to earn extra money.

Teach budgeting

One of our kids recently got to go on a solo trip with a parent. We had a budget for the trip that included gas, food, and souvenirs. Our 12-year-old kept a record and made sure that the souvenir spending still allowed for the food and gas they’d need to buy. This is a simple lesson that pays dividends.

Whether it’s a one-time trip like that or you sit down with older kids or teens and show them your household budget, showing them how to plan ahead and assign money to certain categories will pay off for them in the future.

Encourage saving up for a big goal

If you have one of those kids for whom money burns a hole in his or her pocket, encourage them to save up for a big goal. Even if you’re requiring them to save a certain percentage of money they earn or receive, if they have something they really want, then they may be motivated to save more of their spending money for something in the future.

Credit cards

Contrary to what some financial experts say, credit cards are not always bad. We use credit cards for the rewards points and pay off our balance in full every month. However, letting your child have a credit card without any foundation in money management is not a good idea. As you’re doing the things already listed, explain about credit cards and how they work. Once they are in their teens, they’ll be ready to start building credit (see our tips!).

Resources

Greenlight is basically a debit card, but it’s really a whole program to teach kids about money. Once you have a membership, you can have multiple kids on your account of any age. It allows you to transfer money to their Greenlight accounts from your checking account. You can monitor their spending, set up different categories (like saving, spending, etc.) and even add an allowance feature so that each month they get their allowance without you having to do anything. If you have multiple kids, the $4.99/month price tag is well worth it, and there is a one-month free trial so you can see if it works for your family.

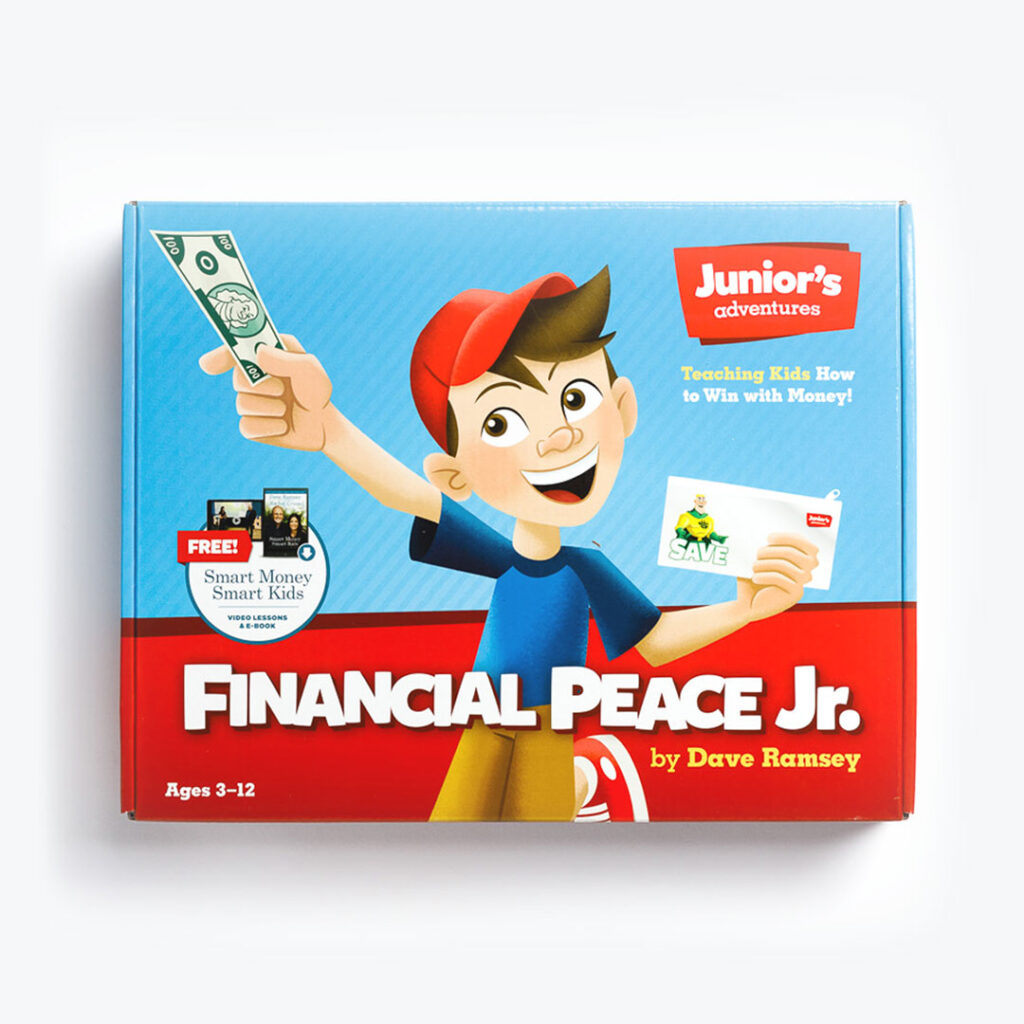

Dave Ramsey Financial Peace Junior is the kid version of the popular Financial Peace program and could be really helpful as you try to teach kids about money. It includes a chore chart, spending envelopes, and an activity book, and a kit for parents to help teach their kids about money. If you have multiple kids, the price goes up for each additional sibling.

Other posts that may help you with how to teach kids about money:

11 Ways Kids Can Earn Money

6 Ways to Get Kids Excited about Saving

9 Chores Kids Can Do to Earn Money