This post may contain affiliate links. Read our disclosure here.

Are you ready to increase your savings, pay off debt, and make 2021 a great year for your finances? This is the perfect time of year to start new habits and really kick your savings into high gear. Saving in your piggy bank was for 4th grade, check out a number of great FREE apps that can help you save for vacations, Christmas and even retirement!

Here are my top 5 apps to help you manage your finances:

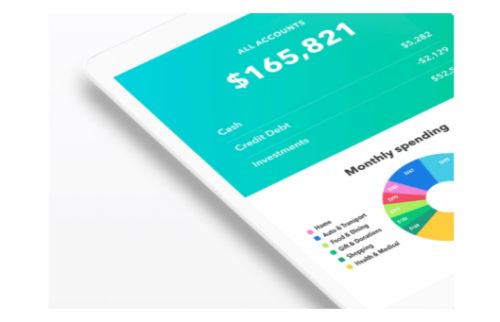

- MINT

This app is probably one of the more popular budget apps and it allows you to see all of your money and bills in one spot. It also automatically detects which budget category a spending might fall into, making it super easy to see where your money is going.

Mint is available online as well as on the go. Logging into your account on the computer has even more features!One other perk of Mint… you can import all your finances straight into Turbo Tax at the end of the year.

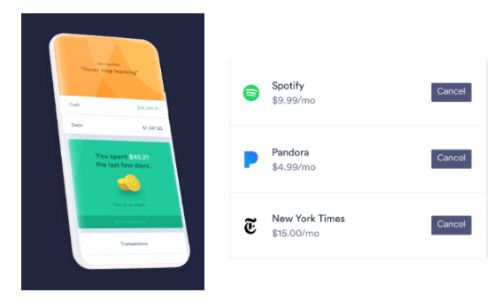

- Clarity Money

While Clarity Money helps to organize your spending, they are widely known for helping you uncover and cancel subscriptions you aren’t using anymore. It also looks for ways to negotiate your bills down to a lower rate. With so many companies now on a subscription model this can save you a lot! You can also set up unique savings goals. Clarity Money allows you to make regular savings deposits into your various goals.They are aligned with Marcus by Goldman Sachs which currently offers one of the highest interest rates on savings accounts 1.7% with no minimum balance needed.

- Acorns

Increase your savings using the Acorns app. The app automatically rounds up your purchases on the credit and debit cards you link to the app. The difference is transferred to an Acorns investment account. Your savings are then invested in mutual funds. You’ll get the option to invest in conservative or aggressive funds based on your risk comfort level.

College students get to use Acorns for free for up to four years. Everyone else has to pay a monthly fee starting at $1 per month.

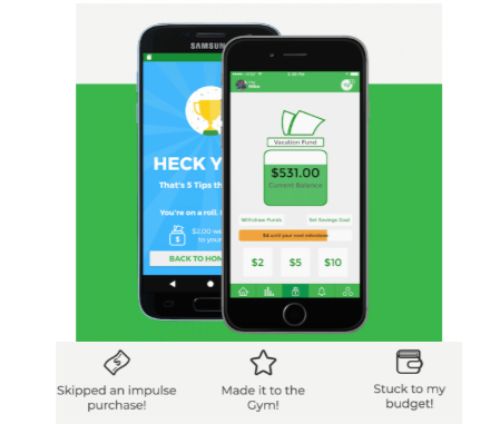

- Tip Yourself

With the Tip Yourself app, you can reward yourself for positive behavior by transferring a little bit of money to your digital tip jar each time you accomplish a personal goal. Set your own personal goals and decide how much each action is worth. Maybe every time you to the gym you can tip yourself $1, there is no limit to your goals and rewards! They move money for you from your current checking account to your savings account (it doesn’t set up new accounts for you).

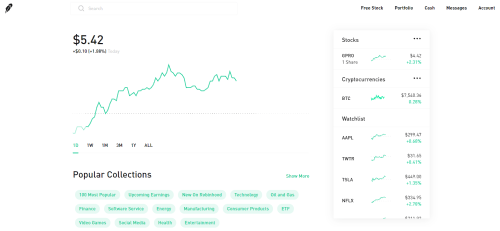

- Robinhood

If you want to try your hand at the stock market a great app to get started is Robinhood. It has zero fees to trade stocks and no minimum balance to get started. You can even own a partial share if you don’t have enough money to buy an entire share. They also have lots of information about each company to help you decide where to invest. Sign up through this link and you’ll get a free stock to get started!