This post may contain affiliate links. Read our disclosure here.

Are you anxiously checking your bank account or mailbox waiting on the tax refund to show up? The IRS states the average tax refund last year was around $1,949 and so far this year refunds are averaging $1,952. I’d be waiting anxiously too if that was what I overpaid.

Sadly most folks are eager for the money to come because they have already decided how they are going to spend it. We treat our tax refund as a little nest egg we’ve been putting money into all year. Our goal though isn’t to save up for rainy days, or college.

I got this picture in an email this week, encouraging me to book a cruise. This isn’t the only one either. There is nothing businesses love more than tax return season. Adults behave just like my 4 year old who walks around the store just wanting to buy anything, she doesn’t care what.

Getting a huge tax refund is the government repaying you for an error you made over the course of the year. They kept your money in a “savings account” for you and with a lovely 0% interest rate. In reality you never had to give them all that excess in the first place.

I have heard a lot of folks that are sad at the idea of not having a refund check, but it’s really the feeling of having a money windfall that you don’t want to lose. This isn’t extra money you’ve found, it’s your money they are giving back to you! If you overpay the electricity bill and they reimburse you, do you immediately go out for dinner to celebrate?

How to Fix Your Taxes

If you got a huge refund last year, and you didn’t have anything unusual that you claimed, then you are probably looking at the same scenario for next year too. Let’s fix this now. You don’t need to let the government hold your money interest free for you. You can save it yourself in an interest bearing account, even better you could invest it and pay even less taxes next year (we’ll get there in a minute).

First things first, let’s fix your withholding. This is the amount that your employer taxes out of your paycheck every pay period and sends to the government for you. The IRS has a nifty little calculator you can use to figure out how much you need to withhold. You’ll need your most recent pay stub and then you’ll be able to answer every question.

At the end it will tell you what to change your withholding numbers too. It even tells you how to fill out the form. Now that numbers are set correctly your refund will be around $50.

Take your updated W-4 form into the office and give it to the person that does payroll. If you get paid twice a month and your refund was the average $2,000 then this means you just put around $77 back in your pocket every single pay period!

2 Ways To Put Your Refund To Work

Open An IRA

When your over payment (aka refund) comes from this year, instead of spending it right away, consider putting it into an IRA. Not only will this earn interest much higher than a local savings account, but depending on the type of IRA you pick it can even make you owe less taxes next year!

For example:

If a pretend person $65,000 in income gets back a $2,000 refund this year and immediately went out and put it in a Traditional IRA it would lower next years taxes by $250! Not mention all the interest it would earn this year. The the $250 tax savings is already like earning 10% interest, and the markets normally earn around 10% interest… so you are easily getting 20% in interest/savings!

Anyone can put in $6,000 into an IRA every year, if you are 50+ you can put in $7,000. You can still put money into an IRA even if you take part in a 401K at work! Don’t be scared at the idea of starting an account it’s as easy as opening a credit card and a lot less scary in the end! If you can send an email, you can do this.

If you want an idea of where to open the account I personally would go with WeBull. They have zero fees and give you free stocks for joining.

Open an Health Savings Account

If you have a high deductible health insurance plan (one that doesn’t have a co-pay but you pay our of pocket until you’ve met your deductible) you can invest up to $6,000 a year in a Health Savings Account (HSA). This money goes in tax free and comes out tax free as long as you use it for medical expenses. The best part, you don’t have to use it this year. It can stay in the account until you are old and grey and move into a nursing home! These accounts can also be invested in the stock market and earn that lovely 10% interest rate.

Which ever option you choose the money you invest will lower next years taxes plus earn way more than the zero earnings the government is offering!

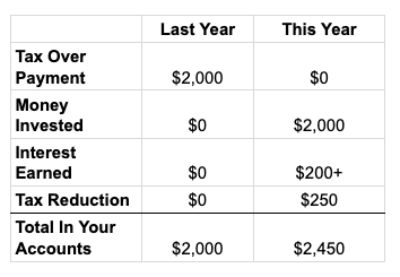

Look at these numbers:

Factor in the interest from investing last years return

and the amount is even higher!!

Keep Saving With Each Pay Check

The IRA or HSA is set up and humming along with your initial refund check as the deposit. Now take that extra bit of money we just found by adjusting your withholding amounts… remember the $77 a pay period… and set up automatic payments to your new investment account. At the end of the year you put in the same $2,000 you were giving the government, so it didn’t affect your bottom line at all. You’ve also earned around $200 in interest and will save another $250+ off next years taxes!

The most important part here is the automatic deposit. If you don’t set up auto payments into the IRA/HSA the likelihood that you will save the money is reduced greatly. You’ve always been overpaying this amount and not living on it, so don’t let yourself get used to the idea of having it. This isn’t a pay raise, it’s just you fixing an overpayment error and being wise with the results!

If you have outstanding interest bearing debts (other than a mortgage), please pay those off first before starting to invest.