This post may contain affiliate links. Read our disclosure here.

Most folks in the US are about to get a chunk of money from their tax refund and/or a stimulus check. Many reports are saying they will start to make direct deposits this weekend stimulus funds!

Many folks need this to pay bills and put food on the table. If you aren’t needing the money quite yet I want to encourage you to save it! There are a few different ways you can save the money and put it to work for you.

Most importantly do not think of this as an instant vacation fund, but instead use it wisely.

How to Use Your Refund & Stimulus Checks Wisely

Save It In Online Savings Accounts

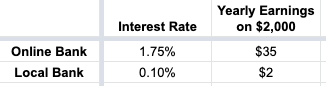

While having a local bank is great, you should consider putting any extra amounts of money into online banks. They are paying up to 1.75% interest right now compared to most local banks that pay .05-.15%. The difference in real money…

Another perk of online banks vs local, is your money is slightly harder to get to. Rather than having it this second, you need 2-3 days to transfer the money to a local bank. This can help you be less likely to spend it on non-important things.

Pay Off High Interest Debt

If you’ve got credit card debt or other debts with high interest rates, you should definitely consider using your refund and stimulus checks to pay off any bad debt. High interest debt compounds quickly and only adds to bills and obligations.

Tip: If you’ve recently lost your job try to negotiate a lower interest rate from creditors before paying off the debt at higher interest rates.

Fund Your Health Savings Account

For folks with a high deductible insurance plan (you don’t pay co-pays but have everything apply to a deductible) are allowed a health savings account to go with their plan. This is a pre-tax savings account that you can put money into. That means it lowers your total income and you don’t owe any tax on the amount in the account. Depending on your insurance deductible, you can put up to $7100 a year in this account. It’s okay to only partially fund it if you don’t have that much.

Even though you are putting your refund or stimulus check in, you’ll still get to take that off your income taxes next year! That’s a double win!

Note: These accounts can be invested in the stock market and make a good chunk in earnings. The money comes out tax free as well, so put your account to work and not just choose a basic 1% interest version. We use Health Equity for ours.

Put it Towards Your Mortgage

If you’ve already got a rainy day fund and extra savings, then take your refund and put it towards your home loan. A one-time extra payment goes straight to your principal and will save you a huge chunk of interest over the life of the loan!

Putting $3,000 towards your mortgage principal would be like paying 2 years of principal payments all at once! Not only did you reduce the life of your loan by two years; you’re also going save the interest payments on that amount for the rest of the mortgage. Head here to calculate exactly what the savings would be for your mortgage.

Save it for Retirement

Consider putting your refund into an IRA. Not only will this earn interest much higher than a local savings account, but depending on the type of IRA you pick it can even make you owe less taxes next year!

For example, if a person with $65,000 in income got back a $3,000 refund this year and immediately went out and put it in a traditional IRA, it could lower next years taxes by $400! Not to mention all the interest it would earn this year. The $400 tax savings is already like earning 10% interest, you are also buying into the markets while they are still down so this is win-win!

Anyone less than 50 years old can put in $6,000 into an IRA every year. You can still put money into an IRA even if you take part in a 401K at work! If you want an idea of where to open the account I personally would go with Vanguard or Schwab. They have the lowest fees and make it very easy.

If you got a much bigger refund than you thought, then you may want to learn how NOT to use your taxes as a savings account.